The Big Short Is Back: Michael Burry Dumps Everything Before the Crash—Except Lipstick

PatriotR Daily News 06/04/25

Impending Doom

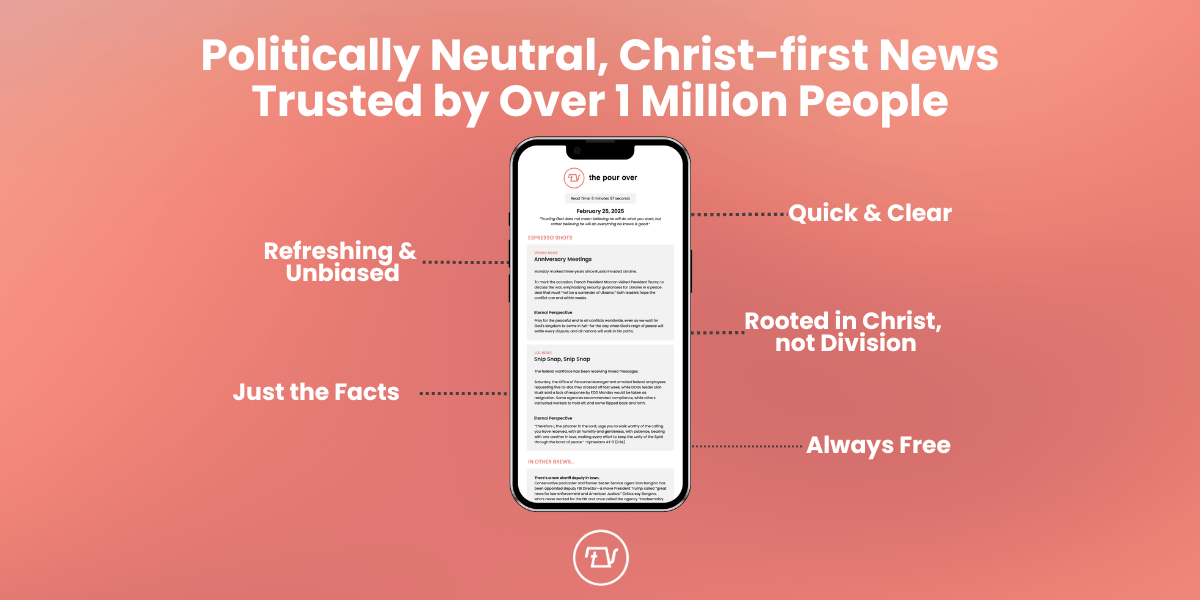

The Pour Over believes the news can be a force for good, helping people find rest and comfort in Christ while spurring them on to action.

Instead of, you know… creating division and a feeling of impending doom.

Join 1 million+ Christians who receive TPO’s politically-neutral, anger-and-anxiety-free, Christ-first news coverage.

US NEWS

The Big Short Is Back: Michael Burry Dumps Everything Before the Crash—Except Lipstick

Michael Burry, famed for predicting the 2008 financial collapse and portrayed in The Big Short, has just liquidated nearly his entire stock portfolio, keeping only one surprising pick: Estée Lauder. Recent SEC filings show that Burry’s Scion Asset Management now holds only seven positions—six are aggressive bearish bets against tech giants like Nvidia and Chinese companies like Alibaba. His lone long position? A $13.2M stake in Estée Lauder, a nod to the “lipstick index” theory where small luxuries remain resilient during economic downturns.

His drastic move comes amid mounting fears of a market collapse fueled by rising U.S. debt (now $36 trillion), surging Treasury yields, and concerns about the “One Big Beautiful Bill”—a Trump-backed spending package forecasted to add $3.8 trillion to the deficit. Jamie Dimon has also issued warnings of an imminent bond market "crack."

FINANCIAL NEWS

Global Power Shift: Central Banks Quietly Hoard Gold While Dollar Wobbles

In April 2025, central banks added a net 12 tonnes of gold to their reserves, a slowdown from previous months but still a strategic move amid escalating global uncertainty. The World Gold Council attributes the dip to record-high gold prices, not a lack of interest—central banks remain committed to gold as a long-term hedge.

Poland led the charge, adding 12 tonnes and surpassing the European Central Bank in total reserves. China, the Czech Republic, Turkey, Kazakhstan, Kyrgyzstan, and Jordan also made notable additions. Meanwhile, Uzbekistan continued offloading gold for the third straight month.

Most striking: several African central banks—Namibia, Rwanda, Uganda, Madagascar, and Kenya—announced new plans to accumulate gold. This wave of interest underscores a global pivot away from fiat dependency, with emerging markets leading the charge.

Despite a month of slower buying, the trend is clear: central banks are positioning for inflation, economic shocks, and weakening fiat currencies. The gold rush is no longer hypothetical—it’s state policy. Read Now.

Want more relevant news?

Get ready to stay informed about the world like never before! Take charge of your knowledge and subscribe today!

|

|

|