Today's Daily Dose of Patriot Truth 5/8/24

ECONOMIC NEWS

Credit Card Debt Accumulates for Small Businesses, Sparking Concerns

Small businesses are increasingly resorting to credit card usage to cope with the dual pressures of high inflation and rising borrowing costs. According to a report from Bank of America, credit card balances held by small businesses have risen by 18% since 2019. This increase comes in response to a 22% jump in the consumer price index over the same period, although when adjusted for inflation, the credit card balance remains comparable to 2019 levels.

Despite these rising balances, there's a silver lining as small business credit card spending has decreased since 2023, indicating that business owners are managing spending and reallocating cash flow effectively. Furthermore, the ratio of total bank loans to net worth for nonfinancial, noncorporate businesses, which includes most small businesses, remains at historically low levels, suggesting relatively healthy balance sheet conditions.

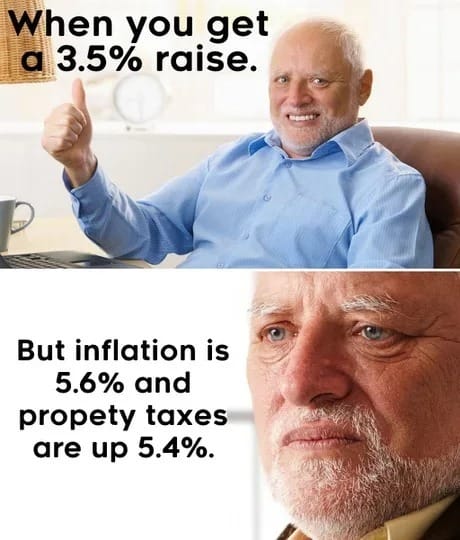

However, the National Federation of Independent Businesses (NFIB) has reported a significant drop in small business optimism, reaching its lowest point since 2012, with inflation cited as the primary challenge due to rising labor and input costs. About 28% of small business owners have responded by raising prices to mitigate the impact of inflation, showing a substantial increase from the previous month. Despite a reduction in inflation from its peak, challenges persist as the consumer price index rose by 3.5% in March, indicating ongoing economic pressures on small businesses. Read More.

FINANCIAL FORECAST

Today's US Economy Update: Banks Tightened Loan Accessibility in the First Quarter

Today, the U.S. economy is facing various pressures, and the Federal Reserve's responses are under scrutiny. Federal Reserve officials, speaking after a recent jobs report, have emphasized the need for more inflation data before committing to any changes in the currently high interest rates. According to remarks at the Milken Institute Global Conference and the Columbia, S.C. Rotary Club, there's a cautious approach to adjusting rates due to inflation exacerbated by the Ukraine conflict and ongoing economic strength.

Meanwhile, a Federal Reserve survey indicates that banks have tightened lending standards across various loan types in the first quarter, including car loans, credit cards, and home equity loans. This tightening is a response to the Fed’s rate hikes aimed at controlling borrowing and spending, although the high rates haven’t slowed the economy as expected. This resilience is partly because many businesses and individuals are still benefiting from low-interest rate loans secured during the pandemic.

In the real estate sector, the New York Federal Reserve’s 2024 housing survey shows that both homebuyers and renters are bracing for higher costs, with expectations of significant increases in home prices and rents this year, contrasting with last year's more optimistic outlook.

For a deeper dive into how these developments are affecting the broader economy and your personal finances, read the full blog on Investopedia. Read Now.

Want more relevant news?

Get ready to stay informed about the world like never before! Take charge of your knowledge and subscribe today!

|

|